Blog

Browse By Category Or Search By Keyword

12 Money Mistakes To Avoid

Charlie Munger is 97 years old and has been Warren Buffett's business partner for five decades. Despite giving away vast amounts of his wealth, he is still worth nearly $2 billion.

One of the traits that has helped Munger become wealthy is his ability to learn from his mistakes, and also those made by others. Munger advises "I like people admitting they were complete stupid horses' asses. I know I'll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn."

How Many Paydays Have You Got Left?

In Time is a 2011 science fiction film featuring Justin Timberlake and Amanda Seyfried. In a dystopian future about 50 years from now, people are genetically engineered to stop ageing at 25. Also at this point, a 12-month countdown clock starts on their arm. Once the clock reaches zero, the person dies. People can increase their clock time - and as a result their lifetime - by transferring time from other people or by downloading time held in special Time Capsules. Time is, therefore, the universal currency.

Why Most Budgets Don’t Work

Learning to control day-to-day spending is the essential foundation upon which financial wellbeing is built. It doesn't matter how much you earn. If you can't control your spending, you'll find it much harder to get on top of your money. And we all know that living payday to payday is really no fun.

Getting control over day-to-day spending is vital to: avoiding racking up debt and the stress that goes with it; being able to handle life's money curve balls and turn a potential drama into a mere inconvenience; being able to afford those little luxuries, like a takeaway, without feeling guilty; being able to pay off debt, build wealth and have more choices and fun.

Do You Need Plastic Surgery?

Many people don't realise what they have until they lose it, which might explain why plastic surgery is a multi-billion pound business. Plastic surgery is the vernacular for cosmetic surgery. And to make it even more confusing, procedures can be surgical (e.g. breast augmentation) or non-surgical (e.g. Botox). The minority of procedures are health-related, but the vast majority are elective, in the sense that they are purely for aesthetic reasons.

Take Small Steps To Be Better With Money

Never in all of history has it been easier to access information. We can watch documentaries and the news on TV and YouTube. Listen to countless radio programmes and podcasts. Access online scientific and research papers, join online forums and watch webcasts. And, of course, we can read or listen to books in order to learn. The world is awash with information.

The 8 Money Milestones

I am naturally an impulsive and spontaneous person, and I love socialising and doing fun things. But when I was younger, those aspects of my personality got me into real bother financially, and I ended up with over £30K of expensive consumer debt. I felt stressed, bad about myself, and ashamed that I was in such a hole.

In desperation, I researched how I might be better with money. I came across US money guru Dave Ramsey and his Baby Steps programme and learnt how other people had got on top of their money.

Lower The Bar

When you are trying to get better at managing your money, it’s easy to become discouraged if you suffer early setbacks. We are more likely to fail to turn good intentions into good outcomes if we have unrealistic expectations. Motivation, always a fair-weather and fickle friend, will wane, and we find it harder to maintain the right financial habits and behaviours.

Look To Life After The Pandemic

For many people around the world the pandemic and associated lockdown has been nothing short of a financial disaster and it is anyone’s guess how long it will take for those who are most affected to recover.

Beyond the immediate financial shock, no one knows how the pandemic will affect world economies and the outlook for jobs, stockmarkets, health and housing costs over the medium to longer term.

Are You On Track To Make Paid Work Optional?

It’s no surprise that the current global Corona Virus pandemic has caused many people to focus on their short-term financial needs and challenges.

But as our economy gradually starts to emerge from the lockdown, and we all start to learn to live with necessary health restrictions, the danger is we resume old spending patterns…

How Will You Spend After Lockdown

If you are like me, you have been spending a lot less during the lockdown period. While we all have different circumstances, lifestyles and preferences, lockdown has reduced the opportunity for spending on things that, while enjoyable or fun in the moment, are neither essential nor necessary.

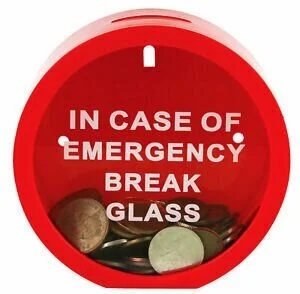

Rethinking The Emergency Fund

As many people are finding out from the COVID-19 pandemic, being able to cope with a sudden drop in income or an unexpected bill is one of the key elements of financial wellbeing. This means having some cash savings easily accessible, to help avoid the need to take on expensive unsecured debt or the need to extend an existing home mortgage.

Three Simple Money Principles To Live By

By now everyone in the UK must be aware of the government’s public health message, designed to help manage the COVID-19 outbreak:

STAY HOME | PROTECT THE NHS | SAVE LIVES

With a handful of exceptions, it seems that most people are adhering to this advice.

Use This Extra Time Wisely

Despite living in rural Suffolk, on the edge of a village with only a handful of houses nearby, last night (Thursday) it was great to hear our distant neighbours join my family in applauding those essential workers who are working long hours to keep core services functioning.

Most people who are either working from home, have been furloughed or sadly seen their work dry up, now have a lot more time on their hands.

Learning From Mistakes

There is an old saying that there is no fool like an old fool.

We all know people who never seem to learn from their past mistakes. Whether it’s choosing unsuitable romantic partners and suffering emotional heartache, doing the wrong job and not being happy or not controlling spending and failing to build financial resources, we all make mistakes. There is no shame in making mistakes, as long as you learn from them.

What Does Good With Money Look Like To You?

There is an old saying that if you don’t know where you are going, you’ll probably end up somewhere else. And when it comes to your relationship with money and your overall financial wellbeing, it helps to know what good looks like. Otherwise, how will you know what changes you need to make and how will you measure progress?

The Monthly Payment Illusion

n the Monty Python film, The Meaning of Life, Terry Jones plays a character called Mr Creosote, a grossly obese restaurant patron. After surveying the menu, Mr Creosote decides to order all the dishes, together with numerous bottles of beer and wine. As Mr Creosote consumes each course, he vomits over himself, much to the disgust of the other diners.

From Zero To Hero

Some money gurus – such as Ramit Sethi in the US and Rob Moore in the UK – make a lot of the importance of people increasing their income to fund their desired lifestyle, and not feeling guilty for that spending.

The idea that you can spend what you want and just find ways to increase your income to fund it sounds very appealing, when compared to the alternative of controlling your spending and making sure that that spending is less than your income.

Five ways To Get Serious About Becoming Financially Free

A lot of people find it hard to plan for their long-term financial future, particularly for life after they stop work – i.e. retirement. Humans are wired to favour the here and now, rather than the dim and distant future, and given a choice of spending for an immediate reward - no matter how fleeting or small - or saving money for a future us that we can’t envisage or relate to, spending now is often more appealing.

Small Steps To Long-Term Financial Wellbeing

When food was scarce and the danger of death was all around, surviving long enough to pass on their genes was the main objective of ancient humans and our brains developed accordingly.

But while the human race has made tremendous progress in eliminating food scarcity and danger to life, our brain hasn’t really changed much. This means we are hardwired to favour instant rewards over deferred gratification.

How To Trick Yourself Into Being Good To Your Future Self

Barely a day goes by without an announcement from the Boris Johnson led Cabinet of new public spending. Health, education, criminal justice and BREXIT preparations are just some of the recently announced priorities that will cost many billions of pounds to deliver.

While the Chancellor, Savid Javid, has said the government can fund all these initiatives from the UK’s current ‘fiscal headroom’ (which means more borrowing), and that may well be the case, it’s also entirely feasible that he could raise taxes to meet some or all of this spending.