Blog

Browse By Category Or Search By Keyword

Are You On Track To Make Paid Work Optional?

It’s no surprise that the current global Corona Virus pandemic has caused many people to focus on their short-term financial needs and challenges.

But as our economy gradually starts to emerge from the lockdown, and we all start to learn to live with necessary health restrictions, the danger is we resume old spending patterns…

Protecting and Improving Your Human Capital

The unfolding Corona virus has hit most advanced economies very hard, as the authorities try to control the public health emergency. Millions of people have either lost their jobs or have been stood down while the lockdown continues and are relying on government funded job retention or benefits support.

Three Simple Money Principles To Live By

By now everyone in the UK must be aware of the government’s public health message, designed to help manage the COVID-19 outbreak:

STAY HOME | PROTECT THE NHS | SAVE LIVES

With a handful of exceptions, it seems that most people are adhering to this advice.

Back To The Future

The two pictures above are of the same place. The one on the left was taken after a savage forest fire. The one on the right is two years later. It’s amazing how quickly the forest regenerated. When things seem bleak, like they do now, remember that they will eventually pass and better times will arrive.

We are certainly living through very uncertain, worrying and scary times.

This Too Shall Pass

British prime minister, Harold Macmillan, was once asked what the most difficult thing about his job was. 'Events, dear boy, events’ is what he is reported to have said.

Whether or not Macmillan said those words, if you are a person, a business or a country, events certainly can throw curve balls, as the current Corona virus situation is proving.

How’s Your FU Fund?

My friend is a degree educated, high-earning senior manager of a major company. He is very smart and used to dealing with complex projects and managing remote teams, so he’s certainly not stupid. Despite all his skills and experience, he found information about the various pensions that he’d accumulated over 30 years of working, confusing, unclear and overwhelming.

The Monthly Payment Illusion

n the Monty Python film, The Meaning of Life, Terry Jones plays a character called Mr Creosote, a grossly obese restaurant patron. After surveying the menu, Mr Creosote decides to order all the dishes, together with numerous bottles of beer and wine. As Mr Creosote consumes each course, he vomits over himself, much to the disgust of the other diners.

Keep It Simple, Stupid

When the Columbia space shuttle took off in January 2003 chunks of insulation foam were observed breaking off and hitting the underside of one of the wings. If the underside of the wing had been damaged, there was a high chance that the shuttle wouldn’t be able to withstand the immense heat on re-entry to the earth’s atmosphere, leading to disintegration of the shuttle.

Why I Love Cash And So Should You

I was recently approached by a chap at my gym who listens to me regularly on the FT MoneyShow podcast. He wanted to know what I thought would happen to the stockmarket over the next six months or so, as he had a large amount of cash sitting about, as a result of a recent property purchase which had fallen through.

I told him that I had no more idea than he did what would happen to stockmarkets over any period of time, but that data from the past 120 years shows that UK equities (with income reinvested) would have turned £100 into about £2.7M, compared to £42,000 from government bonds (gilts) and just over £20,000 from cash, as the chart below illustrates.

How To Make Your Home-Owning Dream A Reality

There is no doubt that buying a home is much more difficult today than it was just 10 years ago. The main measure of affordability is the average price of a house divided by the average salary. In most regions of the UK this ratio has got larger, with London having the highest ratio as the chart below shows.

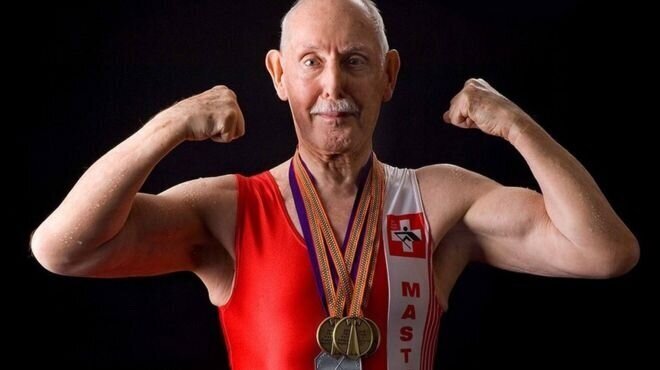

From Zero To Hero

Some money gurus – such as Ramit Sethi in the US and Rob Moore in the UK – make a lot of the importance of people increasing their income to fund their desired lifestyle, and not feeling guilty for that spending.

The idea that you can spend what you want and just find ways to increase your income to fund it sounds very appealing, when compared to the alternative of controlling your spending and making sure that that spending is less than your income.

If It Looks Too Good To Be True…

As part of my ongoing research into personal finance, I recently attended an education session on ‘Serviced accommodation’. This is a form of property investing or business activity which involves letting out residential properties on a very short term – anything from a day to several months – where linen and towels are provided.

This type of letting has really taken off over the past five years, with websites like Airbnb and Booking.com enabling a wide range of people to have a more cost effective, comfortable and flexible alternative to a hotel room.

The Truth About Achieving Financial Freedom

In my earlier post - How to lower the cost of building wealth - I explained how investment returns compound over the long term to build wealth. But the reality for people in the early stage of their working lives is that how much they save each year will have a far bigger impact on the value of their wealth than the level of investment returns they achieve each year. In fact, it isn’t until you’ve done at least 10 years of regular savings that investment returns will outpace the amount of annual contributions to your portfolio. This phenomenon is known as the portfolio size effect.

Your Money Hustle

The key to high financial wellbeing is to make sure that your income and expenditure balance each month, and that some of that spending is for the future you i.e. repaying debt and building financial capital.

As I explained in my blog – Can you afford your job? – if you can’t reduce your spending any further then you will need to find a way to earn more money. Either you’ll need to work overtime, do an additional job or change your main job for a higher salary.

Money Is Time

“Time is money” is a saying that I heard a lot when I was young. The implication being that your time has a value that can be measured in financial terms.

But money can also buy time, in the sense that it enables you to delegate or outsource those tasks which you don’t enjoy or are not good at doing, thereby freeing you up to do those things that you are good at and enjoy.

How To Become Debt Free

Rihanna is a successful 31-year-old singer, actress and fashion designer.

Despite having earned a significant amount of money, by 2010 she was $9 million in debt and on the brink of bankruptcy. Rhianna then sued her accountant, Peter Gounis, for giving her bad advice, saying that he failed to advise her against buying a home for $7 million when her cash position was precarious.

The X-Factor: Why You Need To Understand The Power Of Exponential Growth

A few months ago, I arrived at a venue to give a talk on financial wellbeing. I realised that my iPhone was almost out of power and I had left my charging lead at home. I asked the receptionist of the venue if she had a spare charging lead that I could use.

“Sorry we haven’t got a lead for your type of iPhone, and my own phone is an iPhone X so I can’t let you use mine.” She said. “You have an iPhone X? You must be doing well, they cost over £1,000!” I responded. “No, I do it on contract at £80 per month.” She replied.

The Young Billionaire

Can you imagine being a billionaire?

Well that’s the fortunate situation for US reality media personality, model and social media influencer Kylie Jenner. At just 21 she is reported to be the world’s youngest billionaire, primarily based on the success of the beauty and clothing products business she has built since her teens.

A Good Waste Of Money

Sometimes we waste money by buying things that we either don’t need, or get little benefit from, or that don’t last, or that don’t add to our wellbeing. Sometimes it’s all these things.

But sometimes it’s good to ‘waste’ money, and that includes buying human insurance that you never make a claim on. Human insurance is an insurance policy which pays out if you can’t work due to illness or disability, or you get a critical illness, or you die.

How To Transfer Wealth Successfully

In my latest Financial Times article - Will inherited wealth help or hurt those you love? - I cover the issue of why 90% of families’ wealth doesn’t survive three generations and what to do about it.