Blog

Browse By Category Or Search By Keyword

Do You Need A Better Money Plan?

One definition of insanity is doing the same thing over and over again and expecting different results. If you want to improve your financial wellbeing, you might need to change your approach. You might need a better plan. Your plan can be elaborate and complex, or it can be focused and straightforward.

Do You Need Plastic Surgery?

Many people don't realise what they have until they lose it, which might explain why plastic surgery is a multi-billion pound business. Plastic surgery is the vernacular for cosmetic surgery. And to make it even more confusing, procedures can be surgical (e.g. breast augmentation) or non-surgical (e.g. Botox). The minority of procedures are health-related, but the vast majority are elective, in the sense that they are purely for aesthetic reasons.

Take Small Steps To Be Better With Money

Never in all of history has it been easier to access information. We can watch documentaries and the news on TV and YouTube. Listen to countless radio programmes and podcasts. Access online scientific and research papers, join online forums and watch webcasts. And, of course, we can read or listen to books in order to learn. The world is awash with information.

Get Serious About Your Money Mess

Do you feel in control of your spending, able to cope with life's curveballs and a sense that you're building a solid financial base? Or are you living payday to payday, wondering where your money goes each month? Would one unexpected expense cause a financial meltdown? And are you facing the prospect of working until you drop?

Many people live a rich life in the sense that they spend a lot of their income on consuming and acquiring 'stuff'. Income disappears in a succession of daily contactless card transactions and one-click online purchases.

Millionaire Mindset

There are many definitions of what it means to live a good life. Having enough money to avoid the misery of poverty is a key priority. But so is being able to choose how you spend your time and afford things that make more varied and exciting. While the news is full of tales of woe about how hard it is for people to get ahead financially, it rarely discusses how to build wealth.

The 8 Money Milestones

I am naturally an impulsive and spontaneous person, and I love socialising and doing fun things. But when I was younger, those aspects of my personality got me into real bother financially, and I ended up with over £30K of expensive consumer debt. I felt stressed, bad about myself, and ashamed that I was in such a hole.

In desperation, I researched how I might be better with money. I came across US money guru Dave Ramsey and his Baby Steps programme and learnt how other people had got on top of their money.

University: Is It Still Worth It?

At age 18, Abigail Sweeney was passionate about computer science and the potential for more women to have a role in the male-dominated technology sector. A teacher questioning why she would want to do a “boy's subject” only strengthened her resolve and she managed to secure an offer from Royal Holloway University in London to study computer science.

The controversy about A-Level grades and the impact on students' ability to get into their chosen university has brought back into focus the question of whether it makes sense to go to university.

Why Do You Buy The Things You Do?

Why we buy things and the impact they have on our happiness is something that I've been researching for my new book The Money Miracle. I know my friends enjoy owning and driving their expensive cars and that they add to their happiness. But I wonder if they would enjoy them quite so much if there was no one around to notice them or to whom my friends could compare themselves.

How To Stop Your Emotions Keeping You Poor

The past six months have been a rollercoaster ride for anyone who has capital invested in the stock and bond markets. And given that most people have some form of pension savings, that means almost everyone is affected. Shortly after COVID-19 raised its ugly head, global investment markets fell about 30% during March and April, as investors took fright and headed for the perceived safety of gold, government bonds and cash.

Should You Buy A Property Right Now?

Over the past few weeks, I've been reading and hearing a lot of the same question: “Is now a good time to buy a home?” In this slightly longer than normal blog, I set out some thoughts to help you form your own answer to that question.

Lower The Bar

When you are trying to get better at managing your money, it’s easy to become discouraged if you suffer early setbacks. We are more likely to fail to turn good intentions into good outcomes if we have unrealistic expectations. Motivation, always a fair-weather and fickle friend, will wane, and we find it harder to maintain the right financial habits and behaviours.

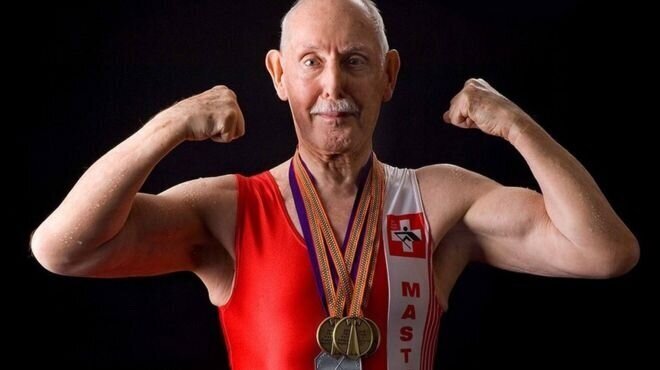

A Long Life: Curse or Blessing?

During the height of the COVID-19 pandemic, an elderly retired army veteran started a sponsored walk around his garden to raise £1,000 for health charities. Three weeks later, Captain Tom Moore reached his 100th birthday and had raised over £30m.

Captain Tom's achievement of raising so much money was remarkable but reaching his 100th birthday wasn't.

How To Cope With Uncertain Financial Times

The media is full of doom and gloom about the global economy arising from the COVID-19 induced economic lockdowns. Whether it’s rising unemployment, the prospect of further mass layoffs, house sales/values stalling or the leisure, hospitality, and travel sectors being on life support, things look bad and are likely to get worse.

Look To Life After The Pandemic

For many people around the world the pandemic and associated lockdown has been nothing short of a financial disaster and it is anyone’s guess how long it will take for those who are most affected to recover.

Beyond the immediate financial shock, no one knows how the pandemic will affect world economies and the outlook for jobs, stockmarkets, health and housing costs over the medium to longer term.

Are You On Track To Make Paid Work Optional?

It’s no surprise that the current global Corona Virus pandemic has caused many people to focus on their short-term financial needs and challenges.

But as our economy gradually starts to emerge from the lockdown, and we all start to learn to live with necessary health restrictions, the danger is we resume old spending patterns…

Money and Relationships

Although all my current financial wellbeing talks and discussions are currently online, before the pandemic I spent a fair amount of my time giving financial well-being talks to groups of employees, senior managers and business leaders all around the world. Usually after my talk some people come up to me with a money related question.

How Will You Spend After Lockdown

If you are like me, you have been spending a lot less during the lockdown period. While we all have different circumstances, lifestyles and preferences, lockdown has reduced the opportunity for spending on things that, while enjoyable or fun in the moment, are neither essential nor necessary.

Rethinking The Emergency Fund

As many people are finding out from the COVID-19 pandemic, being able to cope with a sudden drop in income or an unexpected bill is one of the key elements of financial wellbeing. This means having some cash savings easily accessible, to help avoid the need to take on expensive unsecured debt or the need to extend an existing home mortgage.

You Have All You Need To Weather The Crisis

It was my birthday the other day and I reflected on the half century that I’ve been alive.

I’ve experienced stockmarket crashes, a property slump, recessions, almost going bankrupt, being up to my eyes in debt with no income, a stressful exit from the business I founded, and losing money on a number of other business ventures.

Protecting and Improving Your Human Capital

The unfolding Corona virus has hit most advanced economies very hard, as the authorities try to control the public health emergency. Millions of people have either lost their jobs or have been stood down while the lockdown continues and are relying on government funded job retention or benefits support.